Unlock the latest in medication management technology and grow your care community with us.

Choosing the right health insurance plan can take a lot out of you. With so many options, confusing terms, and ever-changing healthcare needs, it’s easy to feel overwhelmed. This is especially true when you consider that in 2023, approximately 26 million Americans—8% of the U.S. population—went without health insurance, leaving them exposed to crushing medical costs and limited access to care.

Finding the right balance between getting all the coverage you need and keeping premiums affordable takes some careful thought. Choosing your health insurance impacts more than your wallet; it also defines your access to healthcare services, prescription medications, and preventive care throughout the year.

Whether you’re managing a chronic condition, need regular medications, or just want peace of mind, having the right plan can make all the difference. And with tools like DosePacker supporting your health management journey, finding that perfect plan becomes even more rewarding.

Simplify Your Health Journey

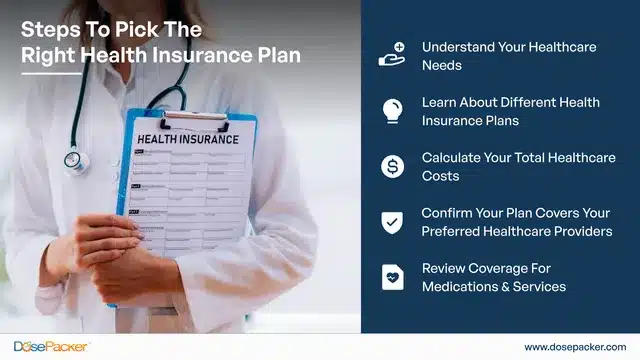

But before you dive into plan options, it’s important to take a step back. The best insurance plan isn’t just the one with the lowest premium—it’s the one that meets your healthcare needs. So, how do you determine what’s right for you?

Assess Your Healthcare Needs

Take a moment to understand what you or your family need. This step ensures you’re not paying for extras you don’t use—or worse, getting stuck with a plan that doesn’t cover essentials.

1. Start With Current Needs

- Do you or a family member have any chronic conditions, like diabetes or high blood pressure?

- How often do you visit doctors or specialists?

- Are there specific prescriptions you take regularly?

2. Think About Future Scenarios

- Are you approaching an age where certain screenings or preventative care might become essential?

- What about unexpected emergencies – do you want a plan with lower deductibles for peace of mind?

3. Factor in Family Dynamics

Consider a holistic approach if you’re planning to get health insurance plans for family members.

- Who needs the most frequent care?

- Are pediatricians, specialists, or mental health services priorities for anyone?

Understand The Types Of Health Insurance Plans

Different health insurance plans offer unique benefits, and understanding these can help you choose one that fits your lifestyle, budget, and healthcare needs. Here’s a quick overview of the different insurance plans you can choose:

Private Insurances

-

- Health Maintenance Organization (HMO)

HMOs require you to choose a primary care physician (PCP) who coordinates all your healthcare needs.

-

-

- Pros

Lower premiums and out-of-pocket costs - Cons

Requires staying within a network of doctors, hospitals and pharmacies. - Best for

People who prefer lower costs and don’t mind limited flexibility in choosing healthcare providers

- Pros

- Preferred Provider Organization (PPO)

-

PPOs offer flexibility to see any doctor or specialist, whether in-network or out-of-network, though costs are lower within the network.

-

-

- Pros

Cost-saving opportunities through HSAs and lower premiums - Cons

Higher upfront costs if you need frequent care - Best for

Healthy individuals or families who don’t anticipate frequent medical needs but want to save for future expenses

- Pros

- Exclusive Provider Organization (EPO)

-

EPOs combine features of HMOs and PPOs, offering a network of providers you must use for coverage without requiring referrals to see specialists.

-

-

- Pros

Lower premiums than PPOs - Cons

No out-of-network coverage except for emergencies - Best for

Individuals who prefer a balance of cost savings and flexibility within a network

- Pros

- High Deductible Health Plans (HDHP)

-

HDHP has lower premiums and higher deductibles and often includes a Health Savings Account (HSA) for tax-advantaged savings.

-

-

- Pros

Cost-saving opportunities through HSAs and lower premiums - Cons

Higher upfront costs if you need frequent care - Best for

Healthy individuals or families who don’t anticipate frequent medical needs but want to save for future expenses

- Pros

- POS (Point of Service)

-

POS plans blend features of HMOs and PPOs. You’ll need a PCP and referrals for specialists, but you can still access out-of-network providers at a higher cost.

-

- Pros

Coordinated care through your primary care physician - Cons

Higher costs and require referrals for specialists, adding extra steps. - Best for

Those who want flexibility but prefer having their care coordinated by a primary care physician.

- Pros

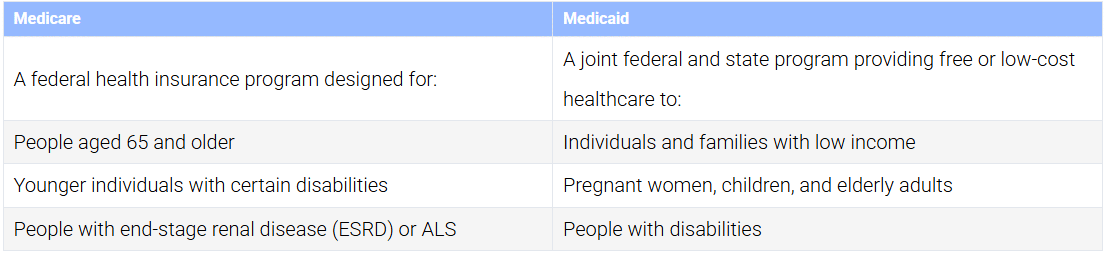

Public Insurance

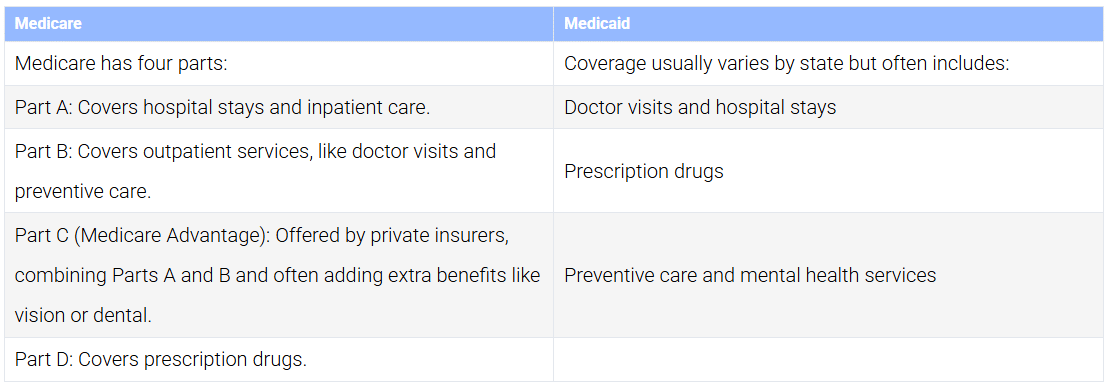

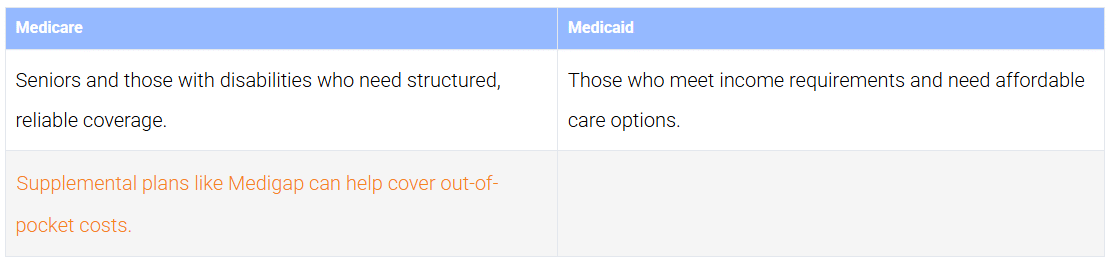

Medicare and Medicaid

Even if you already have private insurance, you should consider Medicare or Medicaid programs to fill gaps in coverage and access additional services.

What Are They?

What Do They Cover?

Who Is It For?

Review Costs Beyond Premiums

While premiums – the monthly fee you pay for insurance – are a significant factor, they’re just the tip of the iceberg. To fully understand the cost of your health insurance plan, you need to dive into these key terms:

1. Deductibles

This is the amount you pay out of pocket for healthcare services before your insurance begins to cover costs.

Example:

If your deductible is $1,500, you’ll pay for all services (like doctor visits or tests) up to that before insurance kicks in.

2. Copayments (Copays)

Regardless of the total cost, it’s the set amount you pay for certain services or medications.

Example:

If your deductible is $1,500, you’ll pay for all services (like doctor visits or tests) up to that before insurance kicks in.

3. Coinsurance

It refers to the percentage of costs you share with your insurance after meeting your deductible.

Example:

If a service costs $200 and your coinsurance is 20%, you’ll pay $40 while your insurance covers $160.

4. Out-of-Pocket Maximums

This is the most you’ll pay in a year for covered services. Once you reach this cap, your insurance covers all of the costs.

Example:

If your out-of-pocket max is $6,000, that’s the most you’ll spend in a year—even if your bills go higher.

If you’re still confused about balancing premiums and out-of-pocket costs, just keep these in mind:

Low premiums + High deductibles

Great if you rarely need care

High premiums + Low deductibles

Ideal for frequent doctor visits or ongoing prescriptions

Check the Network

Ensuring the right network coverage is essential when selecting a health insurance plan. A well-suited network can save you money, time, and unnecessary stress when accessing care.

- Preferred Providers

If you have a primary care doctor or specialists you prefer, make sure they’re part of the plan’s network. - Specialist Care

Regular visits to specialists like cardiologists or dermatologists are important for some families. Ensure these specialists are included in the network. - Hospital Access

Confirm that your plan’s network includes reputable hospitals, clinics, and urgent care facilities. - Convenience and Accessibility

- Location is Key:

In-network providers close to home, work, or school save time and ensure easy access to care. - For the frequent traveler:

If you’re on the move often, consider plans with national or regional networks that offer flexibility for care wherever you go.

- Location is Key:

- Medications and Pharmacies

Confirm that your preferred pharmacy is in-network and provides access to your medications at a reasonable price to avoid unexpected costs.

Evaluate Coverage for Medications and Services

Choosing the right health insurance plan isn’t just about costs—it’s about ensuring it meets your unique health needs. Here’s how to evaluate a plan’s coverage:

Check Prescription Coverage

- Are my medications covered?

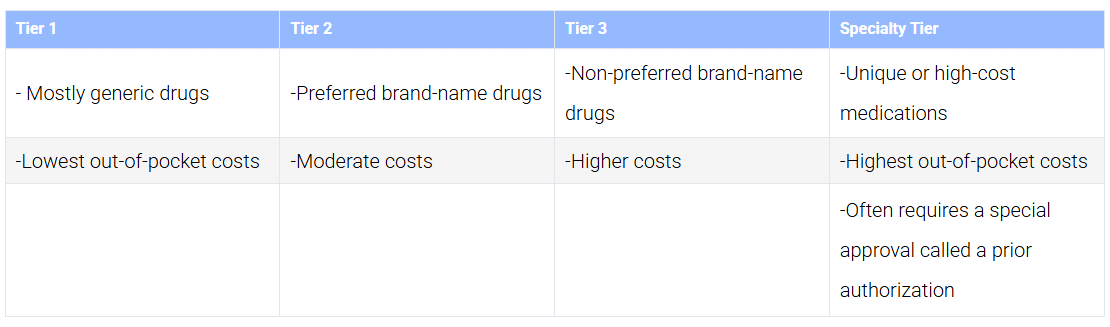

Check the plan’s formulary (the list of covered drugs) to confirm it includes your essential prescriptions. - Understand Drug Tiers

Medications are categorized into tiers that determine your out-of-pocket costs.

Confirm Service Coverage

- Mental Health and Therapy Services: If you require counseling or psychiatric care, ensure the plan provides comprehensive mental health benefits.

- Maternity and Prenatal Care: Planning to have kids? Verify coverage for pregnancy-related services, including prenatal visits and childbirth.

- Preventive Care: Most plans cover services like vaccinations, screenings, and annual checkups at no additional cost.

Look for Additional Perks

- Wellness Programs: Some plans include incentives like discounts for gym memberships, free wellness classes, or smoking cessation programs.

- Telemedicine: Check if virtual doctor visits are included, as these are convenient and often cost-effective.

By thoroughly reviewing a plan’s medication and service coverage, you can avoid surprises later and ensure you get the best value for your health needs.

Empower Your Healthcare Journey

Choosing the right health insurance plan is a big step toward protecting your health and finances. But always remember that your healthcare needs evolve. Make it a habit to:

- Review your plan annually

- Track your healthcare expenses

- Note any changes in your medical needs

- Adjust coverage during open enrollment

Managing healthcare becomes a lot simpler when you have the right tools. With DosePacker’s solutions, you can stay on top of your health needs, no matter your insurance plan. That’s why we’re committed to making healthcare easier and more accessible through:

- DosePack compliance packaging: Innovative medication packaging that helps you stay on track with your medications.

- MyDoses: An app that simplifies prescription management

- Technology that empowers better health outcomes

With the right plan and tools like DosePacker to support you, you’re setting yourself up for a healthier, worry-free future.

Start the Path to a Healthier You

The best health insurance plan isn’t just the one that fits your budget—it’s the one that fits your life. Here’s to your health and making informed choices that support your well-being, today and in the years to come.